Inflation Porn

We’ve certainly heard a lot about inflation in the past year or so. Despite the Bank of Canada’s efforts to fight inflation by raising interest rates sharply, we still see headlines blaring that inflation is very high. What’s behind all this?

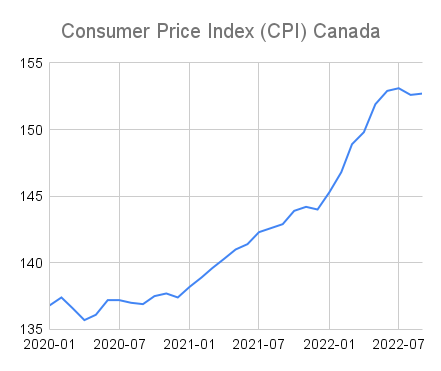

Here is a chart showing the official Consumer Price Index (CPI) for Canada since 2020.

We see that inflation was low in 2020, prices rose sharply during 2021 and the first half of 2022, and prices have actually dropped slightly in the past 3 months. However, this is at odds with headlines still screaming that September inflation was still very high at 6.9%. What gives?

The answer is that we often measure inflation by comparing current prices (as measured by CPI) to what they were a year ago. So, headlines about September inflation are measuring the change from September 2021 to September 2022. Last month’s headlines focused on August 2021 to August 2022. If it seems like the news is churning out stories with 12-month figures where 11 of those months are old news, that’s because you’re paying attention.

The inflation we saw for about 18 months was very real, and it hurts people on fixed incomes. Even though inflation has paused for 3 months, the percentages in the headlines were inflation at 7.6%, 7.0%, and 6.9%. Even if prices stay flat in October, next month’s headlines will say inflation is still high. Apparently, scary headlines are preferable to the news that prices seem to be stabilizing. I guess frightened readers keep reading.

Does this mean our inflation problems are over? I have no idea. We’ll see what the Bank of Canada thinks when they make their interest rate announcement next week. It could be that they hope to drive prices back down somewhat to erase the recent high inflation. But that’s just speculation. What I know for certain is that scary inflation headlines will keep coming for a while, whether they make sense or not.

Comments

Post a Comment