Market Timer Breakeven Date

Market timers often jump out of the stock market when they think it is going down in the hopes of getting back in at lower prices. For this to work, the investor has to get out early enough and back in early enough to avoid selling low and buying high.

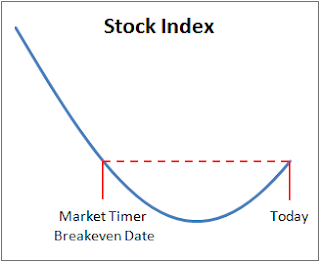

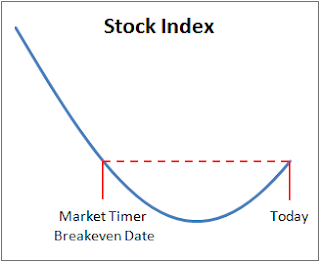

This brings us to the idea of a “market timer breakeven date.” The following picture illustrates what I mean.

Let’s assume for the moment that stocks are now on the rise. A market timer getting back into the market today would have to have sold out of the market before the breakeven date shown in the picture to come out ahead. Any given day we can draw a line over to see the new breakeven date. As stocks rise, the breakeven date moves further into the past sweeping by the exit dates of investors who haven’t jumped back in yet making them losers in the market timing game.

Of course, the stock market doesn’t move in a nice smooth curve like the one shown. It jumps up and down mostly unpredictably. Looking at the chart of the TSX, the most reasonable breakeven date corresponding to today’s closing TSX index level is Oct. 24, 2008.

So, if you jumped out later than this date and haven’t jumped back in yet, odds are that if stocks continue to rise, you’ve lost the market timing game. I’m hoping that the economy continues to improve, stocks keep rising, and the breakeven date keeps moving further into the past.

This brings us to the idea of a “market timer breakeven date.” The following picture illustrates what I mean.

Let’s assume for the moment that stocks are now on the rise. A market timer getting back into the market today would have to have sold out of the market before the breakeven date shown in the picture to come out ahead. Any given day we can draw a line over to see the new breakeven date. As stocks rise, the breakeven date moves further into the past sweeping by the exit dates of investors who haven’t jumped back in yet making them losers in the market timing game.

Of course, the stock market doesn’t move in a nice smooth curve like the one shown. It jumps up and down mostly unpredictably. Looking at the chart of the TSX, the most reasonable breakeven date corresponding to today’s closing TSX index level is Oct. 24, 2008.

So, if you jumped out later than this date and haven’t jumped back in yet, odds are that if stocks continue to rise, you’ve lost the market timing game. I’m hoping that the economy continues to improve, stocks keep rising, and the breakeven date keeps moving further into the past.

Ah yes, and as you left out for simplicity sake, there are certain frictional costs that make market timing that much harder. This includes bid/ask spreads, commissions, and capital gains taxes. Even tax losses have the hitch that you can't get back into the same shares for 30 days or else you have your losses declared superficial.

ReplyDeleteAgain, I know you just left the details out for simplicity... unless I just blew part two.

Gene: All true. I had no part 2 planned -- so you didn't spoil it for me :-) Other complicating factors are the interest on cash balanced against lost dividend payments while the market timer is out of the market.

ReplyDeleteMichael, when do you get to say "told you so" to the market timers who just missed out on a 16% uptick?

ReplyDeleteI guess you ought to hold off until you're pretty sure you won't get another "told you so" when the market heads south again...

Patrick: I'm just going to avoid saying "I told you so" altogether. In the post I was careful to say "let’s assume for the moment that stocks are now on the rise" and "if stocks continue to rise ...". Even if stocks double over the next year, there is no guarantee that they won't come back down again making the market timers who remained out all that time temporarily "right".

ReplyDelete